Kairos presents KIS US Millennials ESG, a themed equity fund, denominated in dollars, which invests in American companies dominating the lives of Millennials.

The consumption, habits and lifestyle of Millennials make them the real stakeholders of the world economy today. Globally, they are the generation with the greatest spending power. KIS US Millennials ESG invests in those companies able to anticipate their needs, and which, given the constant increase in their purchasing power, are today reaping the greatest benefits and will continue to do so in the years to come.

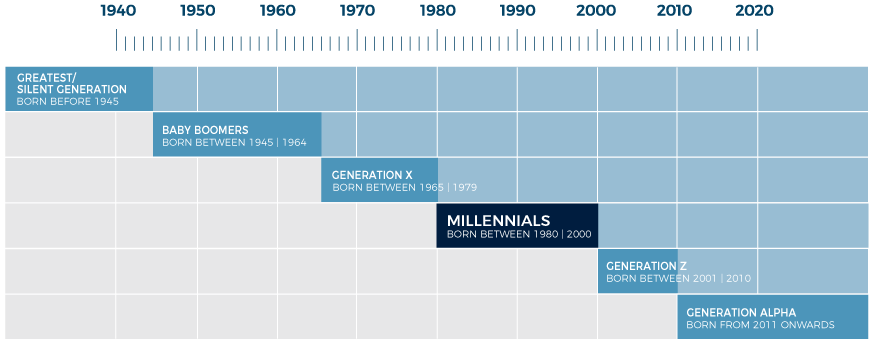

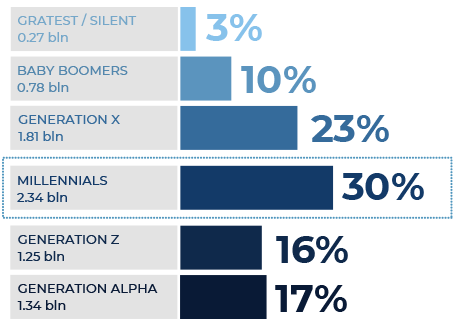

Also known as Generation Y or Digital Natives, Millennials were born between 1980 and 2000 and now amount to about 2.34 billion people, the largest generation on the planet. Growing up in an era marked by great technological progress and globalisation and with a higher income than previous generations, they have led to a transformation of business models and lifestyles, mainly in the United States and Emerging Countries, where the majority of them live. Considering also that Generation Z (1.25 billion), immediately after the Millennials, is continuing with the same preferences, the relative market trend involves about half the world's population.

Millennial is an Anglo-Latinism formed from the Latin term millennium with the addition of the suffix -al, which is used in English to form adjectives. In 1991, the expression "millennial generation” was coined. According to industry literature and the Oxford English Dictionary, the first evidence of the term is attributable to American sociologists and historians William Strauss and Neil Howe, who first used these terms in their book Generations. The History of America's Future, 1584 to 2069, published in 1991 when the thus-named generation was still “budding”, since its members were under 10 years of age. The same authors later continued to monitor this generation, publishing a monograph entitled Millennials Rising in 2000. (Source: Accademia della Crusca)

UNITED STATES

Millennials' labour income in billions of dollars

The percentage of the American workforce relative to Millennials

Annual rate of growth in Millennials' labour income registered at the end of 2019

Millennials’ spending in billions of dollars

Source: Kairos elaboration on United Nations.info data, Bureau of Labor Statistics, Accenture. Figures in dollars as at the second quarter of 2020.

US Millennials ESG, the themed equity fund from Kairos International Sicav, sets out to offer medium to long-term capital appreciation. KIS US Millennials ESG is a low correlation fund that invests its portfolio in listed companies in the United States, which are expected to benefit from the growing importance of the consumer preferences of the Millennials generation.

Starting from the MSCI USA* index, the fund’s benchmark, Kairos' internal search initially filters the basket by selecting only companies related to the Millennials theme. Through in-depth analysis, the Team then excludes companies that do not represent an economically sound investment and includes others, not in the index, that benefit from the theme, have valid fundamentals and attractive income prospects. In addition, it optimises sectoral composition, with the aim of making the investment sphere more uniform. The implementation of two strategies, to optimise the risk-return ratio and exploit volatility through the use of options, completes the Portfolio creation process.

In line with Kairos' ESG policy, the stock selection process integrates traditional financial considerations with ESG factors and according to the assessments offered by Sustainalytics, one of the leading European independent ESG rating agencies, which Kairos uses for ESG research.

This product is suitable for any type of customer who wants to diversify the equity component of his or her portfolio with a product denominated in dollars and focused on the US market, in turn, diversified among various sectors. Since it refers to a number of mega trends, the millennials theme also allows the Fund managers, and therefore subscribers, to take advantage of multiple levers which, suitably implemented in the portfolio, should be able to diversify the risks — each mega trend in fact has its own specific cycle — safeguarding most of the yield potential.

* Source: MSCI. MSCI makes no express or implied warranties or representations and assumes no responsibility for the MSCI data contained herein. MSCI data may not be further redistributed or used as a basis for other indices, securities or financial products. This document has not been approved, validated, reviewed or produced by MSCI. MSCI data is not intended to constitute investment advice or a recommendation to make (or refrain from making) any type of investment decision and should not be construed as such.

To find out more about the features of KIS US Millennials ESG

CLICK HERE >