ABOUT

Kairos Multi-Strategy is a multi-asset product that invests in hedge funds on a global scale and represents one of the most established solutions within the Kairos product range. Known for its expertise in dynamic and non-directional portfolio management, Kairos aims to generate stable returns over time while maintaining a contained level of risk.

This is an investment solution that can represent an alternative performance engine, enhancing overall portfolio efficiency through diversification across strategies, asset classes, sectors, and geographies. Kairos Multi-Strategy is a global fund, with exposure that can vary opportunistically based on the market context in which to operate, thanks to dynamic portfolio management.

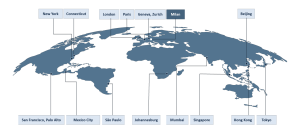

The management team selects the best managers around the world with a distinctive competitive edge in the various asset classes and expertly combines them in light of the specific macroeconomic and financial context. Portfolio choices are the result of a solid analytical process informed by a tight network of relationships cultivated over time, a network of over 1.500 professionals active in the main financial centers.

The principle of diversification, which hinges on asset classes different from the more classic bonds and shares and on non-directional management strategies, and the experience in the selection process represent the strengths of the product.

Kairos Multi-Strategy is proposed as an investment solution with bond-like volatility, the fund offers low correlation to traditional fixed income indices.

The investment involves a risk component, consequently the originally invested capital may not be recovered in whole or in part. Past performance is not a guarantee of future results. The Kairos Multi-Strategy synthetic risk indicator is classified at level 3 out of 7.

PORTFOLIO MODEL

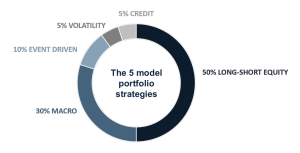

The Kairos Multi-Strategy portfolio is diversified across a range of five alternative strategies, with tactical allocations made to specific strategies and managers. These allocations are informed by direct assessments from the multi-manager team, allowing for adjustments that can amplify or moderate certain portfolio positions.

The five model portfolio strategies are:

- LONG-SHORT EQUITY 50%: the net exposure is dynamically adjusted to capitalize on rallies and minimize the impact of market dips, even going so far as to neutralize beta.

- MACRO 30%: a variety of market and asset class strategies are strategically combined to capitalize on macroeconomic trends.

- EVENT DRIVEN 10%: generating profits from special situations and corporate events, irrespective of market conditions.

- VOLATILITY 5%: exploiting arbitrage opportunities within the volatility surface across various asset classes.

- CREDIT 5%: investing with a relative value approach in a diverse range of corporate credit instruments, both in the High Yield and Investment Grade spaces.

The investment approach is characterized by a strong focus on the transparency and liquidity of the strategies in which the fund invests. The team actively avoids opaque financial structures and those involving excessive leverage, ensuring a more stable and clear investment foundation.

THE MANAGEMENT TEAM

Kairos has chosen Moreno Tatangelo and Mario Unali, both Head of Funds of Funds, to manage Multi-Strategy. They have a long experience in fund selection, which has allowed them to build over time an extensive network of relationships with industry professionals.

Disclaimer

This is a marketing communication for advertising purposes for Kairos Multi-Strategy, an open-end alternative investment fund (AIF) intended for professional investors and the other investors specified in the Offering Document (“Fund”). Please refer to the Offering Document and the Key Information Document (KID) before making any final investment decision. TThese documents are available in Italian on the website www.kairospartners.com and at the registered office of Kairos Partners SGR S.p.A. (“Kairos”) and placement agents, also in a paper copy. A summary of investor rights is available in Italian and English at https://www.kairospartners.com/sintesi-dei-diritti-dei-partecipanti-al-fondo-it-en/. Past performance is shown net of expenses borne by the Fund and before taxes. Past performance does not predict future returns. The investment implies a risk component, consequently, some or all of the originally invested capital may not be recovered. Exchange rates movements may affect the value of the investment and costs when expressed in a currency other than the investor’s reference currency. Information on the features of the Fund and general sustainability aspects (ESG) can be found at www.kairospartners.com/esg/, in compliance with Regulation (EU) 2019/2088. If the Fund is marketed in countries other than the country of origin, Kairos has the right to terminate the marketing agreements based on the withdrawal of notification process provided for by Directive 2011/61/EU.

The information and opinions provided herein do not constitute a public offer, nor a personalised recommendation. They do not represent a contract and are not prepared in accordance with a legislative provision, nor are they sufficient to make an investment decision and are not intended for persons residing in the United States of America or other countries in which the Fund is not authorized for marketing. The information and data are deemed correct, complete and accurate. However, Kairos does not provide any express or implied representation or warranty as to the accuracy, comprehensiveness or fairness of the data and information and, when they have been drafted by or derive from third parties, assumes no liability for the accuracy, comprehensiveness, fairness or adequacy of such data and information, although the sources used are considered to be reliable. When not specified otherwise, the data, information and opinions are to be deemed updated at the report date and may be subject to changes with no prior notice or subsequent communication. Any citations, summaries or reproductions of the information, data or opinions provided herein by Kairos must not alter the original meaning, nor can they be used for commercial purposes and must cite the source (Kairos Partners SGR S.p.A.) and the website www.kairospartners.com. Citation, reproduction and, in any case, use of the data and information of third parties it must occur, when allowed, in full compliance with the rights of the relative owners.

Kairos Partners SGR SpA | Via San Prospero 2 I 20121 Milan – VAT No. 12825720159 | All rights reserved.